"A year from now you may wish you had started today."

— Karen Lamb

About Oakwood Wealth Management

You can count on our financial planning expertise, as we work in harmony with you to achieve the financial goals that you set. We understand that your financial goals are unique so our team will work directly with you to create a custom-tailored financial plan that will provide a foundation for you to build and preserve wealth for you and your family.

We offer comprehensive advisory services to families and individuals across Australia, so whether you're in the process of building your wealth, or if you're near or already in retirement, the team at Oakwood Wealth Management can make financial planning more manageable.

Our services are provided by a professional designated adviser that will work diligently for you and your family. We pride ourselves in building and nurturing long term client relationships based on a client-centric service model that focuses on personal interaction, individual attention, professionalism, and integrity. We're based in Melbourne's south-east suburb of Chadstone and serve clients throughout the area and many surrounding suburbs including Carnegie, Oakleigh and Toorak, alongside all of Victoria.

Finalist for Superannuation Adviser of the year-2025

Finalist for Superannuation Adviser of the year-2025

Our Services

- Holistic Financial Planning

-

Understand where you want to be.

We look at all aspects of your personal and financial life.

- Retirement Planning

-

It pays to be prepared

We can give you clarity and confidence about your life in retirement.

- Investment Planning & Strategy

-

Make smarter decisions with your investments

Getting quality investment advice is the cornerstone to building long term wealth.

- Taxation Advice

-

Strategic & personalised taxation advice

Tailored advice to ensure your tax strategies are working for you.

- Superannuation

-

Visualise your path to retirement

Maximise the potential of your super and make the most of your nest egg.

- Personal Insurance

-

Life is risky business

Insurance is essential to achieving and maintaining financial security.

- Cash Flow / Debt Management

-

Build a strong financial foundation

Managing cashflow and reducing debt are critical steps towards financial freedom.

- Estate Planning

-

Plan today for your family's future

Deliver peace of mind for yourself and for your loved ones.

Our Process

The path to financial confidence starts with your complimentary initial consultation with our financial adviser. Your free one hour consultation can be held in one of our many offices across Melbourne or through Skype or over the phone, its completely up to you. It’s an opportunity for you to ask questions about our experience, qualifications, testimonials and talk informally about your goals and ambitions aswell as giving you the chance to get to know the adviser.

If at the initial meeting we both agree there is a sound basis to proceed we will outline the scope of our advice and our fees. A Fee Engagement will be provided to you for your agreement before any advice is provided. No fee will be charged without your prior approval in writing.

Once our service enagement has been agreed on your Financial Adviser will then go away and perform in depth research and analysis in order to formulate suitable strategies that will allow you to achieve all your desired financial goals and objectives.

The end result will be a personalised Financial Plan that will be clearly outlined in your Statement of Advice.

Start getting the support you need and book a consultation with one of our team members today. Call us on (03) 9562 4567 or make an enquiry via email at admin@oakwoodwealth.com.au and one of our staff will get back to you as soon as possible.

- Our Fees

-

No tricks. No surprises. No unexpected charges.

There is no 'cookie cutter' financial planning template - every client has different needs and goals. We aim to simplify the customer experience by providing you with the products and services that help you, eliminating the need to navigate complicated 'one size fits all' plans and pricing structures.

- Ongoing Service Program

-

Get up to date and ongoing financial advice

Our commitment is to provide ongoing advice and management of your strategy, including regular performance reporting, communication about investment markets and maintenance of your investment portfolio and insurance coverage to ensure that your strategy remains relevant and on track.

- Meet the Team

-

We keep the wheels at Oakwood turning

Inspiring our company, clients and community towards a better and smarter financial financial future.

Testimonials

Latest Financial Planning News

AI exuberance: Economic upside, stock market downside

The key findings of Vanguard’s economic and market outlook to be released in...

Becoming a member of an SMSF is easy, but there are other things that need to be considered

There are very few restrictions on who can become a member of an SMSF, but there are conditions with which...

Investment and economic outlook, November 2025

The latest forecasts for investment returns and region-by-region economic...

Move assets before death to avoid tax implications

Mitigating the impact of death benefit tax can be supported by ensuring the SMSF deed allows for the transfer...

ATO issues warning about super schemes

The ATO is warning SMSF trustees to be on the look out for superannuation and tax...

12 financial tips for the festive season and year ahead

Some investing steps to get you through the holiday season, the new year, and for the...

Birth date impacts bring-forward NCCs

The provisions allowing SMSF members to trigger the NCC bring-forward rules in a subsequent financial year are...

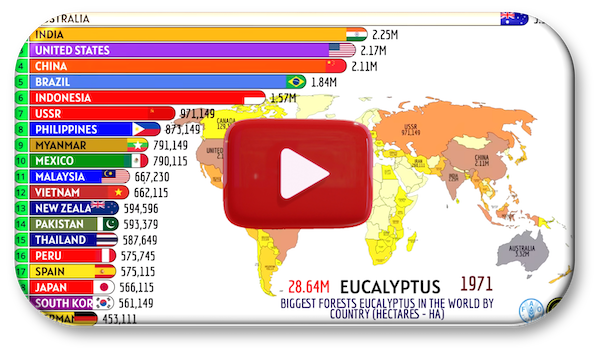

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

How to budget using the envelope method

Here's five simple steps to create a budget that doesn't involve tracking every...

Tools & Resources

Contact Us

Get in Touch

Oakwood Wealth Management welcomes your enquiry. To book an appointment or simply ask us a question fill in your details and we'll be in touch soon!

Location

- Chadstone Tower 1, Level 8, 1341 Dandenong Road, CHADSTONE VIC 3148

Phone Number

Office Hours

9am-6pm AEST/AEDT, Monday to Saturday